Why It Matters

In emergent categories like heat pumps, consumer knowledge and brand recognition is notably lower than other consumer categories like fast-moving consumer goods, leaving room for factors like performance, sustainability, and trusted recommendations to take centerstage. Even though more than 50% of consumers would be open to installing heat pumps, a mere 4% of consumers have researched the costs and benefits of heat pumps. Northwind data also suggests that network effects among family and friends do the heavy lifting and are the primary trust-building avenue for potential customers, in lieu of any specific brand connotations.

Most heat pump installations occur just after a system breaks down. But this can pose a challenge for heat pump brands, installers, and contractors: how do you make the right system design recommendations and build customer trust without the support of a known brand name behind you or the luxury of time?

Analysis of this touchpoint reveals that customers are more opinionated, price-sensitive, and open to newness than some might expect.

Two Truths and a Surprise

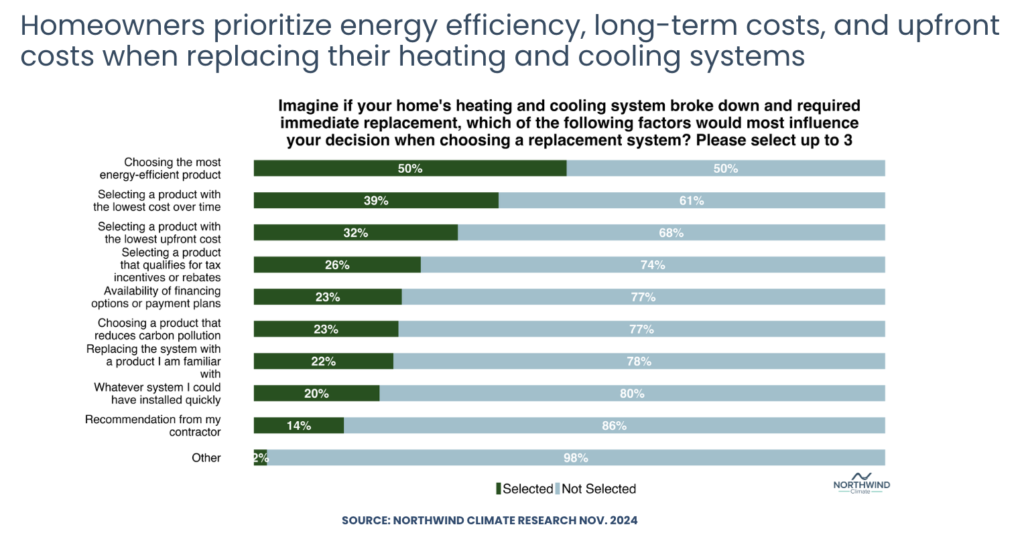

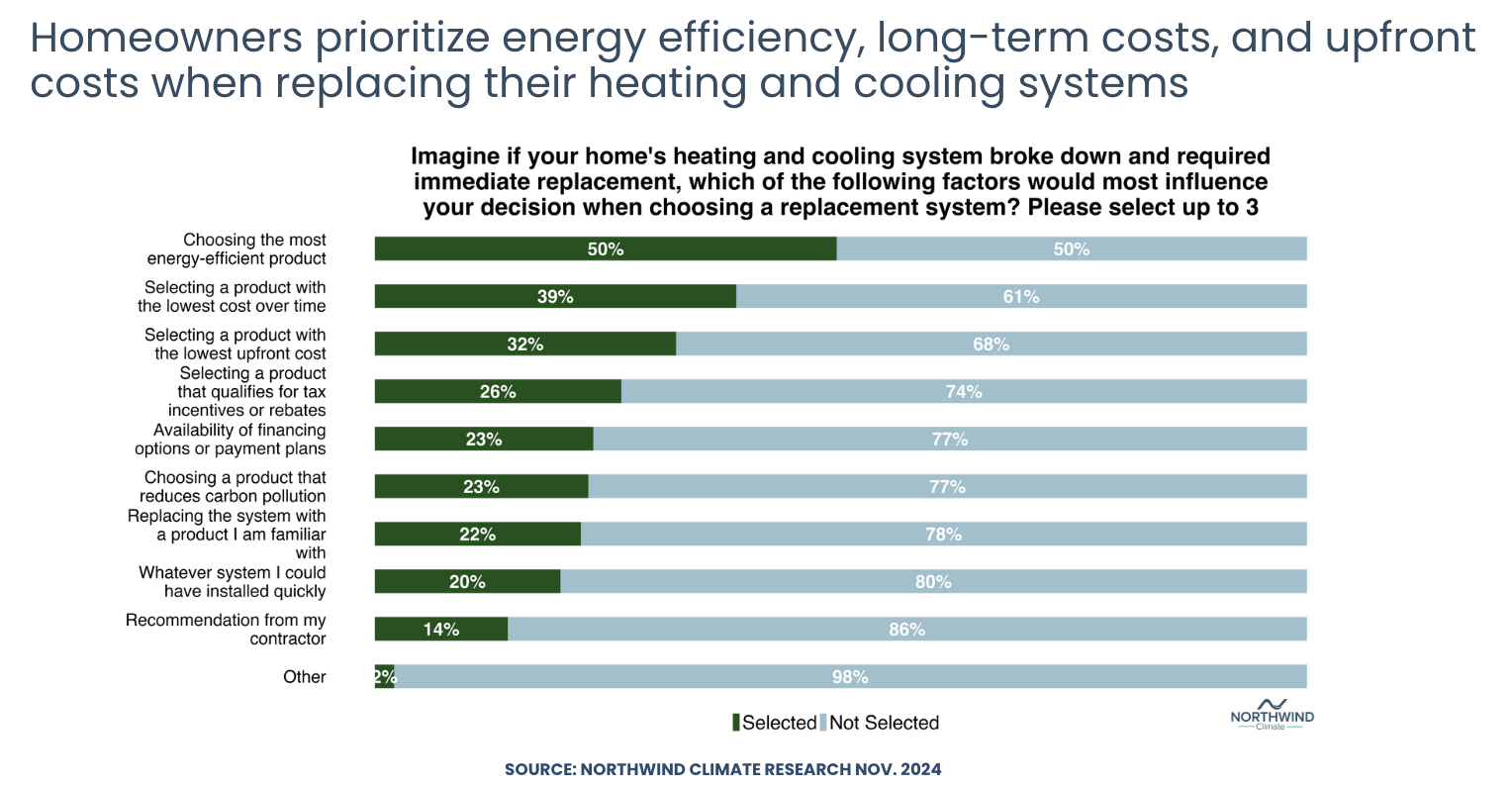

Energy efficiency is the most important message for contractors to deliver, but contractors are rarely the deciding factor in a customer’s purchase. When asked which factors would “most influence your decision when choosing a replacement system,” half of respondents selected “choosing the most energy-efficient product”. Considering HVAC systems can use up to 50% of a home’s electricity, this makes sense, and is a message that resonates across climate segments. Only 14% of respondents selected “recommendation from my contractor,” suggesting consumers have stronger preferences to navigate than simply agreeing to the contractor’s recommendations. Even if they’re not in and of themselves the most influential source of information, contractors remain one of the most frequent conduits to that information and should lean on the efficiency message whenever possible.

“Tax rebates” are nice; lower sticker price is even better. Of top considerations, 39% of respondents selected “a product with the lowest cost over time” and 32% of respondents selected “a product with the lowest upfront cost.” As exciting as tax incentives and rebates are for the growth of the category as a whole, consumers prefer to understand cost through the lens of total and monthly costs – not rebates (selected by 26% of respondents). If the fine print of the rebates allow, do the math most important for customers – rebate-adjusted monthly costs or overall sticker price – to remove a negative frame from their decision matrix (cost pre-rebates).

System familiarity and install speed is a lower priority than expected; this is a major opportunity. Twenty-two percent of respondents selected “the system with a product I am familiar with” and only 20% selected “whatever system I could have installed quickly,” suggesting that even though HVAC replacements are assumed to be urgent replacements, especially in colder climates, consumers are willing to be patient for the right system install. This critical finding means that installers should always fully scope the project in order to deliver great news about energy efficiency and reduced costs on time, instead of a quick fix too soon.